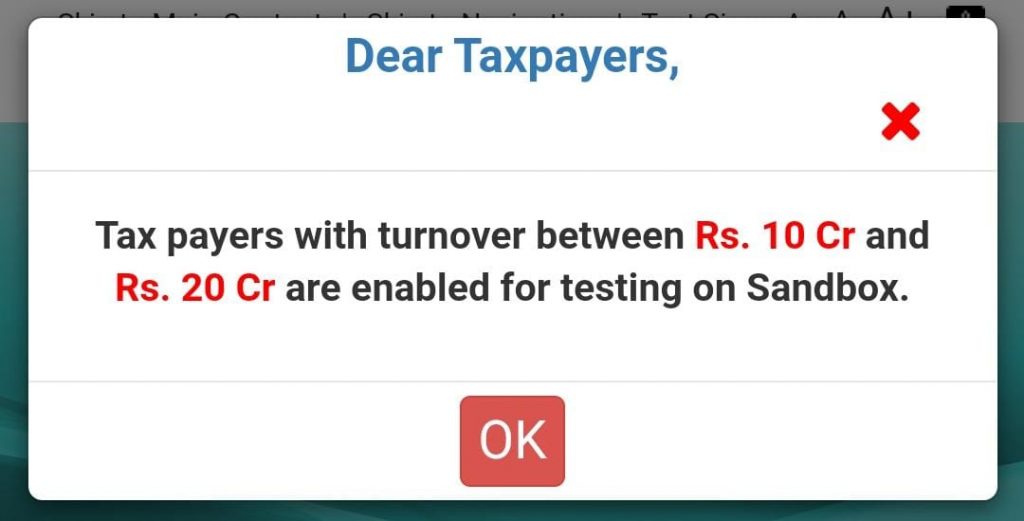

E-invoicing is likely to be soon notified for taxpayers with turnover B/w Rs. 10 Cr and Rs. 20 Cr

As per the new update issued by GST, e-Invoice system says the taxpayers with turnover between Rs. 10 crore and Rs. 20 crore are enabled for testing on the Sandbox system.

The following validations are implemented:

- Reverse charge is not applicable for transactions if the recipient taxpayer type is ISD

- Deemed exports is allowed for recipient taxpayers with taxpayer type as Regular or Casual

- Tax rate 0.5% is withdrawn

Source #GST e-Invoice system