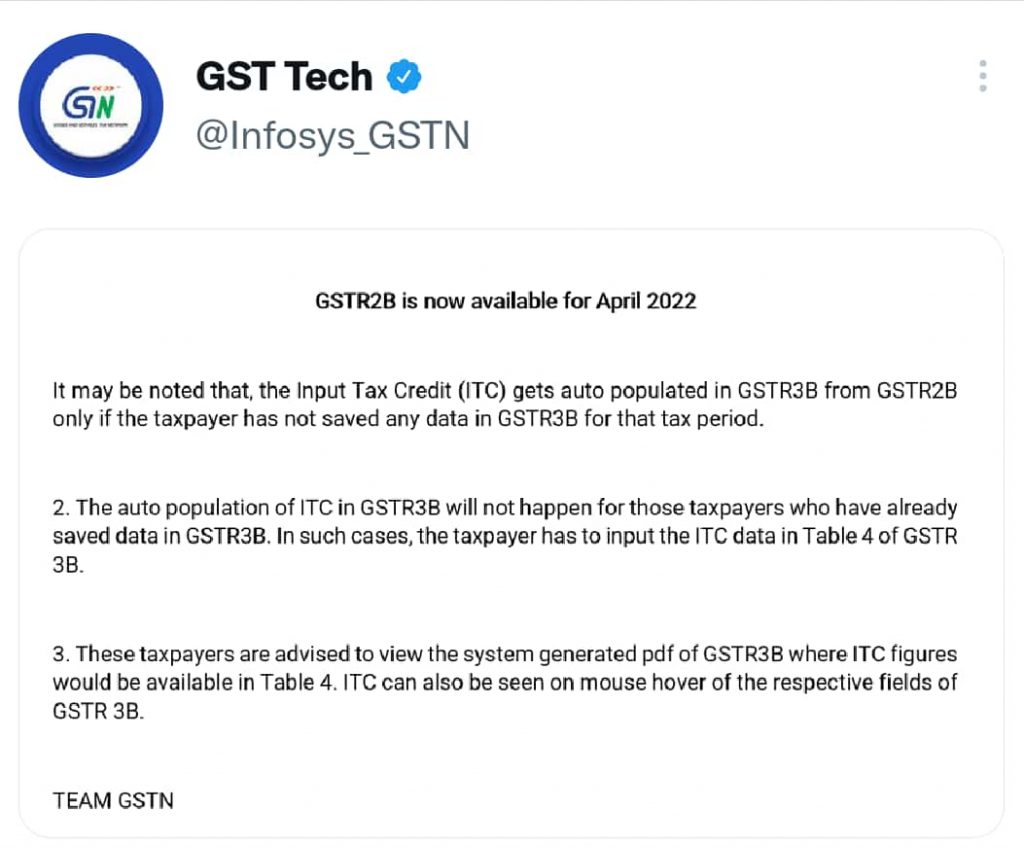

GSTN: GSTR-2B is now available for April 2022 on GST Portal

It may be noted that, the Input Tax Credit (ITC) gets auto populated in GSTR-3B from GSTR-2B only if the taxpayer has not saved any data in GSTR-3B for that tax period.

The auto population of ITC in GSTR-3B will not happen for those taxpayers who have already saved data in GSTR-3B. In such cases, the taxpayer has to input the ITC data in Table 4 of GSTR-3B.

These taxpayers are advised to view the system generated pdf of GSTR-3B where ITC figures would be available in Table 4. ITC can also be seen on mouse hover of the respective fields of GSTR-3B.

Source from - https://twitter.com/Infosys_GSTN/status/1526811792886071296