New Table 3.1.1 in GSTR-3B for reporting supplies notified u/s 9(5) of the CGST Act

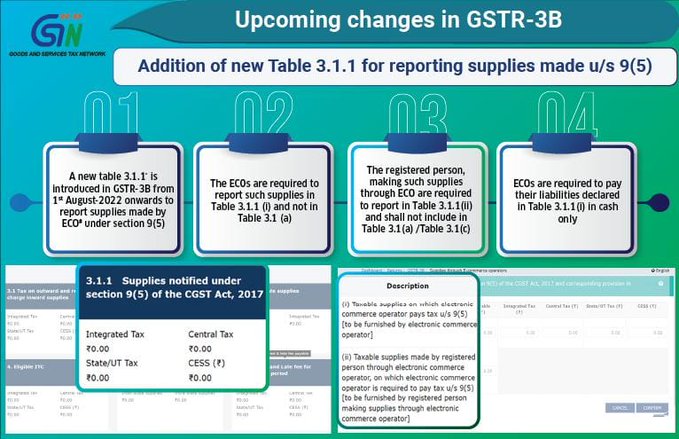

The Goods and Services Tax Network (“GSTN”) has issued an Advisory dated July 20, 2022 inserted new Table 3.1.1 in GSTR-3B for reporting supplies notified u/s 9(5) of the Central Goods and Services Tax Act, 2017 (“the CGST Act”).

As per Section 9(5) of CGST Act, Electronic Commerce Operator (ECO) is required to pay tax on supply of services such as Passenger Transport Service, Accommodation services, Housekeeping Services & Restaurant Services, if such services are supplied through ECO.

A new Table 3.1.1 is being added as per Notification No. 14/2022 – Central Taxdated 05th July, 2022in GSTR-3B where both ECOs and registered persons can report supplies made under Section 9(5) as mentioned below.

To view the detailed notification, please click here.

3.1.1. Details of supplies notified under sub-section (5) of section 9 of the Central Goods and Services Tax Act, 2017 and corresponding provisions in Integrated Goods and Services Tax/Union Territory Goods and Services Tax/State Goods and Services Tax Acts.

|

Description |

Total Taxable Value | Integrated Tax | Central Tax | State/UT Tax | Cess |

| (1) | (2) | (3) | (4) | (5) |

(6) |

|

(i) Taxable supplies on which electronic commerce operator pays tax under Sub-section (5) of Section 9 [To be furnished by the electronic commerce operator] |

|||||

|

(ii) Taxable supplies made by the registered person through electronic commerce operator, on which electronic commerce operator is required to pay tax under Sub-section (5) of Section 9

[To be furnished by the registered person making supplies through electronic commerce operator]. |

|

An ECO is required to report supplies made u/s 9(5) in Table 3.1.1(i) of GSTR-3B and shall not include such supplies in Table 3.1(a) of GSTR-3B. The applicable tax on such supplies shall be paid by ECO in Table 3.1.1(i) of GSTR-3B in cash only and not by ITC.

A registered person who is making supplies of such services as specified u/s 9(5) through an ECO, shall report such supplies in Table 3.1.1(ii) and shall not include such supplies in Table 3.1(a) of GSTR-3B. The registered person is not required to pay tax on such supplies as the ECO is liable to pay tax on such supplies.

Table 3.1.1 in GSTR-3B will be made available on GST Portal from August 01, 2022.

The Advisory can be accessed at - https://www.gst.gov.in/newsandupdates/read/549